Let’s Start a Conversation

How can we help?

Points of Contact

U.S. | Unlock SBA 7(a)

110 Painters Mill RD, STE 209,

Owings Mills, MD 21117

General Inquiries

443 – 625 – 9313

Support

Please note: all fields are required.

FAQs

What Do You Need to Know?

At our Unlock SBA 7(a) support, we're dedicated to finding innovative answers to your questions

What is the difference between SBA 7(a) and SBA 504 loans?

SBA 7(a) loans are general-purpose loans for small businesses, offering flexibility in usage, while SBA 504 loans are specifically for purchasing fixed assets like real estate or equipment, aimed at business growth and job creation.

How can the SBA 7(a) loan benefit my business compared to other loan options?

SBA 7(a) loans provide broader eligibility and more flexible usage options compared to other loans, making them suitable for various business needs.

What documents are required for an SBA 7(a) loan application?

Essential documents for an SBA 7(a) loan application include a business plan and various financial documents such as profit & loss statements.

What are the eligibility criteria for obtaining an SBA 7(a) loan?

Eligibility criteria for an SBA 7(a) loan typically involve factors like business size, creditworthiness, and ability to repay the loan.

Can I use the funds from an SBA 7(a) loan for any business purpose?

Funds from an SBA 7(a) loan can be used for various business purposes including working capital, purchasing equipment, refinancing debt, and real estate.

What are the repayment terms for an SBA 7(a) loan?

Repayment terms for SBA 7(a) loans vary depending on the purpose of the loan, with terms of up to 10 years for working capital and equipment loans, and up to 25 years for real estate loans.

How do I choose between the DIY, assisted, and full-service options offered by Unlock SBA 7(a)?

Choose between DIY, assisted, and full-service options based on your preference for handling the loan application process and level of assistance needed.

What sets Unlock SBA 7(a) apart from other loan assistance services?

Unlock SBA 7(a) stands out for its tailored solutions, offering comprehensive assistance in preparing loan documents and providing various service tiers to meet diverse customer needs.

How do I purchase the DIY, assisted, or full-service option from Unlock SBA 7(a)?

To purchase our services, simply go to the Offers page and select the option that best fits your needs: DIY for $499, We Help You Do It for $1,499, or We Do It For You for $5,000. Then, follow the prompts to complete the checkout process.

How can I reach customer support for assistance with my purchase or any questions about the services provided by Unlock SBA 7(a)?

For assistance with your purchase or any questions about our services, please contact our customer support team via email at [email protected] or by phone at 443 – 625 – 9313. Our dedicated support team is ready to help you with any inquiries or concerns you may have.

Testimonials

What Our Client Say

Sarah t.

"I was super worried about applying for a business loan, but Unlock SBA 7(a) made it way less scary. With their help, I got all my documents sorted and even had someone to chat with when I had questions. It was like having a buddy hold my hand through the whole thing. Thanks to them, I got the funding I needed without pulling my hair out!"

Michael r.

"I was drowning in paperwork trying to get my business loan sorted. Then I found Unlock SBA 7(a), and boy, what a lifesaver! Their $1,499 deal was perfect for me. I got all the docs I needed, plus some one-on-one time with Paul to help me out. It was like having a personal coach for my loan application. I'm telling all my entrepreneur buddies about them!"

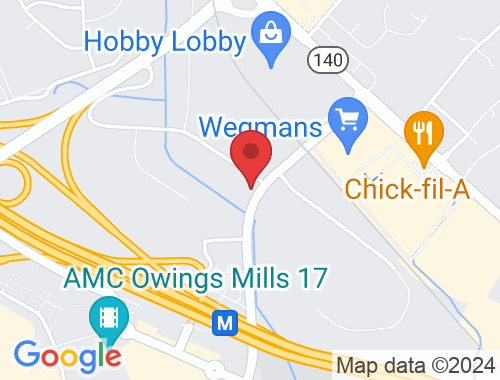

Address Location

110 Painters Mill RD STE 209 Owings Mills, MD 21117

443 – 625 – 9313

© 2024 Unlock SBA 7(a). All Rights Reserved

Powered by: Growth Buddy™

© 2024 Unlock SBA 7(a). All Rights Reserved

Powered by: Growth Buddy™